7 Pros and Cons of a Peer-to-Peer (P2P) Payment Network

Popularized by apps like Venmo, PayPal, and CashApp, P2P payments let people quickly send funds while keeping sensitive details hidden. In an increasingly digital world where virtual realities like the metaverse gain ground, P2P payments continue to grow.

In 2021, the worldwide P2P payment market was valued at $1.8 trillion in 2021 by Vantage Market Research, which estimated valuation would surpass $5.2 trillion by 2028 with a 19.5% CAGR in the forecast period.

Piggybanks everywhere feel a little more at peace these days, seeing as how P2P payments have increased their lifespan. | Source: Pixabay

But what is a peer-to-peer network, and what are some of the pros and cons of these types of financial interactions? Keep reading to learn more and to find out what P2P payments are and their pros and cons.

What Is A Peer To Peer Network?

Users who sign up for a P2P payment service first link a bank account, credit card, or another payment method.

After doing so, a person can send and receive money from other users on the same platform. Generally, all that’s needed to send a payment is for a user to have someone’s username, email address, or phone number to find their account.

And once you’ve paid or been paid by someone, most systems like PayPal, pictured above retain the contact to make future transactions even more accessible.

Once funds are received, a P2P network user can either hold funds or transfer money to a bank.

The usefulness of sending and receiving money quickly without needing bank account details is alluring to many consumers. A Spring 2022 NerdWallet study found that 94% of Millennials, 87% of Gen Zers, and 88% of Gen Xers use mobile payment P2P apps like Zelle, Cash App, and Venmo.

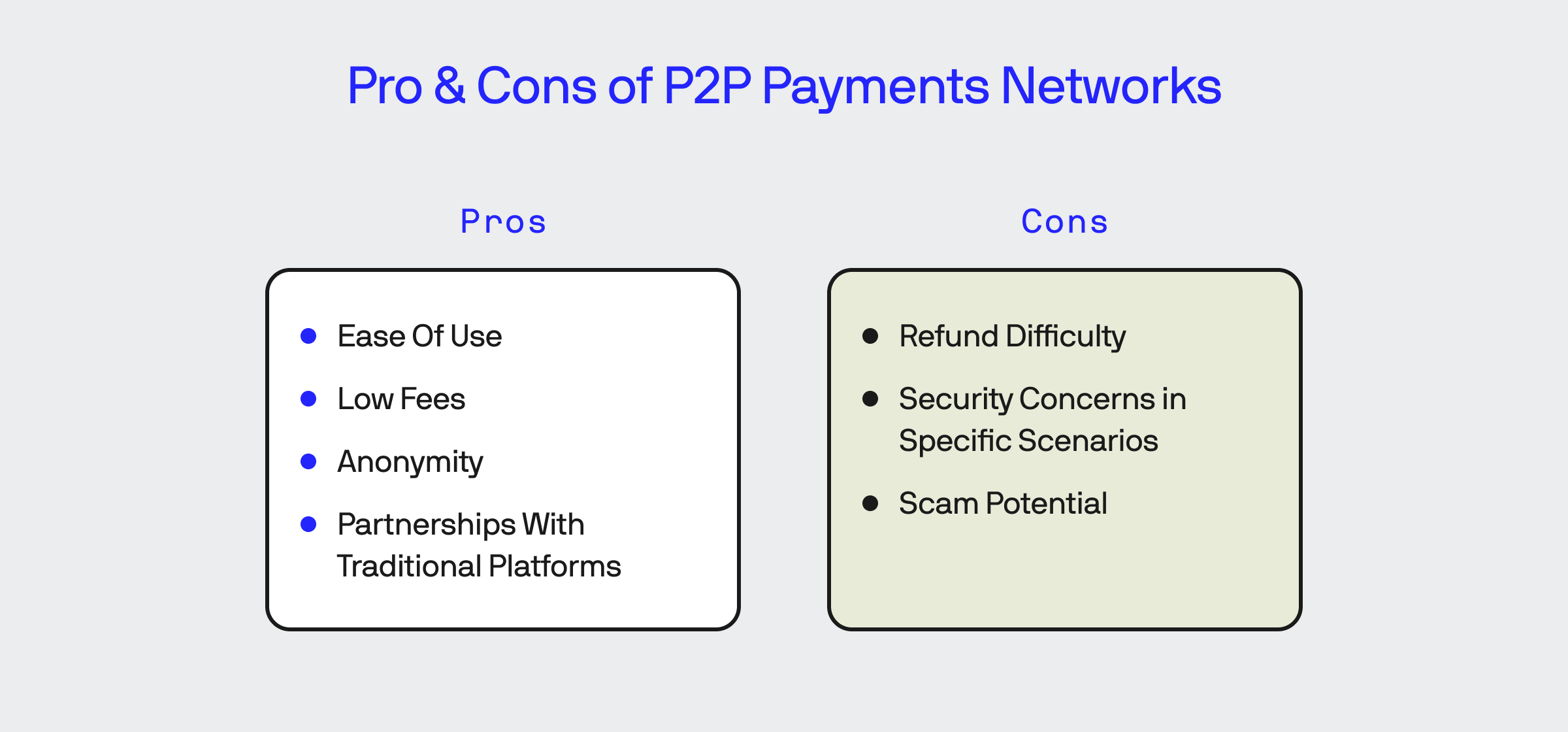

What Are The Pros & Cons Of P2P Payment Networks?

While P2P payment networks have many positives, there are a few downsides consumers should be aware of concerning traditional banking and credit platforms.

Pro: Ease Of Use

P2P payment networks are often very user-friendly and allow people to send money instantly to anyone in their network. Traditional bank transfers can take hours or days to clear even though technology, such as augmented reality, is trying to help modernize banks.

Con: Refund Difficulty

The lack of go-betweens can make it extremely difficult, or almost impossible, to get a refund if something goes wrong with a payment. It can also be tricky to dispute transactions to come to a fair conclusion, especially when sending money to the wrong user and it’s someone you don’t know personally.

Pro: Low Fees

Due to the lack of a middleman, peer-to-peer networks often feature much lower transaction and currency conversion fees than traditional banking architecture. Some platforms charge no fees, while others might tack on 2-3% on top of a transaction. According to Clover, users can achieve up to 75-90% savings on currency conversion rates by “bypassing banks and brokers.”

Con: Security Concerns in Specific Scenarios

While P2P networks are usually very secure due to encryption and fraud-monitoring abilities, potential security concerns can arise if a user’s phone is compromised or stolen. A thief could easily gain access to a phone and, in turn, to a user’s P2P network account to initiate fraudulent transactions.

Pro: Anonymity

P2P network users can transact with very little identifying information. This is a plus to privacy-conscious people who might wonder how more prominent financial institutions use customer data, trends, and other key information for their benefit.

Con: Scam Potential

Engaging with users means Peer-to-Peer network users must be careful about where they send money. Some malicious users might craft scams where purchased items are not shipped or even pretend to be officials from financial agencies to trick people into making payments. For example, CashApp doesn’t offer buyer protection, thus making it a target for scammers and less ideal when stacked against other systems for significant transactions.

Pro: Partnerships With Traditional Platforms

The popularity of P2P platforms means some traditional banks and credit unions have teamed up with these types of networks to offer additional services. Some legacy institutions even have their own P2P payment networks – giving users various options to pay and receive money.

P2P Payments

P2P payment networks only grow in scope and influence as more consumers rely on them for day-to-day activities.

Prospects for the industry look strong as people realize the benefits of fast and cheap payment solutions as digital transformation continues to shift the financial sphere.

Bobby Gill